Introduction

As the end of the Fringe Benefits Tax (FBT) year approaches on 31 March, employers across Australia must review their FBT obligations to ensure compliance with the Australian Taxation Office (ATO). Failure to accurately report fringe benefits or meet lodgement deadlines can result in penalties, interest charges, and increased scrutiny from the ATO.

This guide provides a comprehensive overview of the steps businesses should take to prepare for the close of the FBT year, including identifying applicable benefits, ensuring correct record-keeping, and exploring available exemptions. A practical example is also included to illustrate the process.

Fringe Benefits Tax Preparation (FBT):

What Employers Must Do Before 31 March 2025

Understanding Fringe Benefits and FBT

A fringe benefit is defined as a non-cash benefit provided to an employee or their associate (e.g. a family member) in connection with their employment.

These benefits are subject to taxation under the Fringe Benefits Tax Assessment Act 1986 (Cth).

Unlike income tax, FBT is levied on the employer and is calculated on the taxable value of the benefit provided.

The FBT year runs from 1 April to 31 March.

Common fringe benefits include:

- Private use of employer-provided vehicles

- Entertainment expenses (meals, events, tickets)

- Low-interest or interest-free loans to employees

- Housing or accommodation allowances

- Salary packaging arrangements

Source: ATO – Types of fringe benefits

Step 1: Review All Provided Fringe Benefits

To accurately report and calculate FBT, employers must identify all fringe benefits provided throughout the FBT year.

This includes any benefit, no matter how minor, that is not in the form of salary or wages but is provided due to employment.

Example:

A company provides a sedan to an employee for work-related and personal use. If the vehicle is used for private travel—even occasionally—it constitutes a reportable fringe benefit.

This usage must be logged and valued appropriately.

What to do: Review internal payroll, accounts, and HR records to identify all such benefits. Ensure incidental or occasional benefits are not overlooked.

Step 2: Maintain Accurate and Up-to-Date Records

The ATO mandates comprehensive record-keeping for all benefits that may be subject to FBT.

These records must be retained for a minimum of five years.

Records may include:

- Logbooks for vehicles (for the operating cost method)

- Receipts/invoices for entertainment and other expenses

- Employee declarations (e.g., for shared use or partial reimbursement)

- Salary sacrifice agreements

- Loan agreements showing applicable interest rates

Source: ATO – Keeping FBT records

What to do: Conduct a record audit before 31 March. Ensure all required documentation is complete and accurate.

Step 3: Calculate the Taxable Value of Benefits

There are various valuation methods depending on the type of fringe benefit. Choosing the appropriate method can help reduce FBT liability legally.

Examples of Valuation Methods:

- Company Cars: Choose between the statutory formula method (a flat rate based on the car’s cost and days available for use) or the operating cost method (based on actual costs and percentage of business use).

- Entertainment: May be valued using the actual cost method or the 50/50 split method, depending on record-keeping practices.

- Loans: Compare the interest charged by the employer with the benchmark rate set annually by the ATO. The difference may be taxable.

Source: ATO – Valuation rules

What to do: For each benefit, assess which valuation method offers the most accurate and compliant outcome, and calculate taxable values accordingly.

Step 4: Account for Employee Contributions

In certain cases, employees may make post-tax contributions toward the cost of a fringe benefit.

These contributions can offset the taxable value, thereby reducing the employer’s FBT liability.

Example:

If an employee reimburses $1,000 towards the cost of using a company car privately, that amount is deducted from the taxable value.

What to do: Ensure that all employee contributions are made and recorded before 31 March, and that corresponding documentation is retained.

Step 5: Assess Eligibility for FBT Exemptions and Concessions

Some benefits are wholly exempt from FBT or receive concessional treatment.

Employers should explore these options to lawfully reduce their liability.

Common exemptions include:

- Work-related items such as portable electronic devices (phones, tablets, laptops)

- Minor benefits valued at less than $300 and provided infrequently

- Public transport or parking under specific conditions

- Concessions for not-for-profit organisations

- Small businesses (turnover under $50 million) may access broader exemptions on work-related devices

Source: ATO – FBT exemptions

What to do: Determine eligibility for exemptions and apply them to reduce your reportable fringe benefits.

Step 6: Prepare for Lodgement and Payment

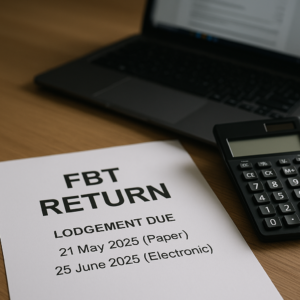

Businesses are required to lodge an annual FBT return if they have provided any taxable fringe benefits during the year.

The lodgement dates vary depending on the method:

- Paper lodgement: due by 21 May 2025

- Electronic lodgement (via tax agent): due by 25 June 2025

Source: ATO – FBT lodgement due dates

What to do: Begin preparation early. If you have a tax agent, coordinate in advance. Also, plan for any financial impact of FBT payable.

In summary…

Fringe Benefits Tax Preparation is not simply an annual compliance exercise—it’s an opportunity to review internal policies, reduce unnecessary tax burdens, and align employee benefits with broader business strategies.

By proactively identifying all benefits, maintaining accurate records, choosing the most appropriate valuation methods, and applying for relevant exemptions, businesses can streamline their FBT obligations and avoid last-minute errors.

For complex fringe benefit structures or concerns regarding valuation and exemptions, consulting a registered tax agent or accountant is advisable.

Disclaimer For External Distribution Purposes

The information contained in this publication is for general information purposes only, professional advice should be obtained before acting on any information contained herein. The receiver of this document accepts that this publication may only be distributed for the purposes previously stipulated and agreed upon at subscription. Neither the publishers nor the distributors can accept any responsibility for loss occasioned to any person as a result of action taken or refrained from in consequence of the contents of this publication.

Contents

- 1 Introduction

- 2 Fringe Benefits Tax Preparation (FBT): What Employers Must Do Before 31 March 2025

- 3 Understanding Fringe Benefits and FBT

- 4 Step 1: Review All Provided Fringe Benefits

- 5 Step 2: Maintain Accurate and Up-to-Date Records

- 6 Step 3: Calculate the Taxable Value of Benefits

- 7 Step 4: Account for Employee Contributions

- 8 Step 5: Assess Eligibility for FBT Exemptions and Concessions

- 9 Step 6: Prepare for Lodgement and Payment

- 10 In summary…