Understanding Testamentary Trusts:

How to Protect Your Children’s Inheritance

If you’re preparing your estate plan and want to ensure your children are financially protected after your passing, a testamentary trust could be one of the most powerful tools at your disposal.

Unlike a standard will, which simply distributes assets outright, a testamentary trust can provide structured control, legal safeguards, and tax advantages that offer long-term security—especially if your beneficiaries are minors or vulnerable to financial mismanagement.

This article breaks down what a testamentary trust is, how it works, and why it’s an excellent strategy for inheritance protection in Australia. If you haven’t already considered the legal guardianship of your children, we recommend reading our article on Guardian for Your Children for a complete picture of family trust planning.

What Is a Testamentary Trust?

A testamentary trust is a trust that is established through a person’s will and comes into effect only upon their death.

It is a legal structure that appoints a trustee (someone you trust) to manage your estate’s assets on behalf of the named beneficiaries, such as your children or grandchildren.

The assets—such as cash, real estate, or shares—are not distributed directly to the beneficiaries.

Instead, they are held in trust and managed under specific instructions outlined in your will.

This differs from a discretionary family trust, which is often set up during your lifetime and serves broader tax and estate planning purposes.

A testamentary trust is specific to your will and activated only after you pass away.

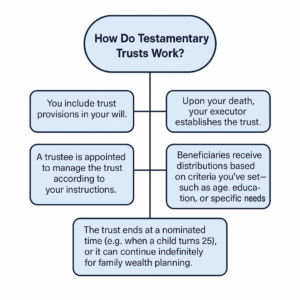

How Do Testamentary Trusts Work?

Here’s a simplified overview of how testamentary trusts operate:

- You include trust provisions in your will.

- Upon your death, your executor establishes the trust.

- A trustee is appointed to manage the trust according to your instructions.

- Beneficiaries receive distributions based on criteria you’ve set—such as age, education, or specific needs.

- The trust ends at a nominated time (e.g., when a child turns 25), or it can continue indefinitely for family wealth planning.

Key Benefits of Testamentary Trusts

1. Asset Protection

One of the major advantages of a testamentary trust in Australia is asset protection.

If your child is going through a divorce, bankruptcy, or legal dispute, the assets in the trust are generally protected from creditors or former spouses.

Example: If your adult child inherits assets directly and later divorces, their inheritance may be considered part of the marital asset pool.

In contrast, a testamentary trust helps keep it separate and protected.

2. Tax Efficiency

A testamentary trust offers significant tax advantages, particularly for minor beneficiaries.

Unlike family trusts, income distributed to minors from a testamentary trust is taxed at adult tax rates, not the punitive child tax rates applied in other contexts.

This can result in thousands of dollars in tax savings per year if structured and distributed wisely.

3. Control Over Inheritance

Testamentary trusts allow you to delay or stage the release of funds. This is particularly useful if your children are young, financially inexperienced, or have special needs.

Example: You may instruct the trustee to distribute funds only for education, healthcare, or milestones (such as turning 25 or buying a first home).

4. Flexibility for Trustees

Trustees typically have discretionary powers, meaning they can decide how and when to distribute income and capital based on the needs of the beneficiaries at any given time.

This is useful in managing:

- Changing personal circumstances

- Health issues

- Relationship breakdowns

- Future education or care needs

Who Should Consider a Testamentary Trust?

Testamentary trusts are most appropriate for:

- Parents with minor or dependent children

- Families with blended structures or multiple marriages

- Individuals with vulnerable beneficiaries (e.g., those with addiction issues or disabilities)

- High-net-worth individuals seeking tax flexibility

- Business owners protecting intergenerational wealth

Appointing a Trustee: A Vital Decision

Choosing the right trustee is crucial. They will have control over how the trust operates and must act in the best interest of the beneficiaries.

You can appoint:

- A trusted family member

- A professional (e.g., lawyer or accountant)

- A corporate trustee (e.g., a trustee company)

Tip: You may also consider appointing a second person (or committee) as a “protector” to oversee the trustee’s actions.

Testamentary Trust vs Standard Will: What’s the Difference?

| Feature | Standard Will | Testamentary Trust |

|---|---|---|

| Asset Control Post-Death | Low | High |

| Tax Efficiency for Children | Low (minor taxed at high rates) | High (minor taxed at adult rates) |

| Protection from Divorce/Debt | No | Yes |

| Suitable for Young Beneficiaries | Limited | Excellent |

| Estate Planning Flexibility | Basic | Advanced |

How to Set Up a Testamentary Trust in Australia

Creating a testamentary trust requires professional legal advice and careful drafting in your will. Steps include:

- Consult an estate planning lawyer or specialist accountant.

- Decide on the trust’s terms—who the beneficiaries are, trustee appointments, distribution rules.

- Include clear clauses in your will.

- Ensure your executor understands their role in establishing the trust upon your death.

- Review your estate plan regularly to account for family or financial changes.

Final Thoughts

A testamentary trust offers more than just a way to leave your money to your kids—it provides a powerful framework for protecting that inheritance, reducing tax, and ensuring that your legacy is used as you intended.

For parents of minor children, it’s particularly valuable in tandem with guardianship decisions.

To understand how appointing a guardian works, read our companion article on Guardian for Your Children.

By combining thoughtful guardianship with strategic estate tools like testamentary trusts, you give your children not just financial security—but peace of mind for the future.

Disclaimer For External Distribution Purposes

The information contained in this publication is for general information purposes only, professional advice should be obtained before acting on any information contained herein. The receiver of this document accepts that this publication may only be distributed for the purposes previously stipulated and agreed upon at subscription. Neither the publishers nor the distributors can accept any responsibility for loss occasioned to any person as a result of action taken or refrained from in consequence of the contents of this publication.

References & Sources

- Australian Taxation Office (ATO). “Trusts: income of children from testamentary trusts.” https://www.ato.gov.au

- ASIC MoneySmart. “Estate Planning.” https://moneysmart.gov.au/estate-planning

- Legal Aid NSW. “Wills and Estates.” https://www.legalaid.nsw.gov.au

- CPA Australia. “Testamentary Trusts.” https://www.cpaaustralia.com.au

Would you like a featured image and LinkedIn post to go with this article?

Contents

- 1 Understanding Testamentary Trusts:

- 2 How to Protect Your Children’s Inheritance

- 2.1 What Is a Testamentary Trust?

- 2.2 How Do Testamentary Trusts Work?

- 2.3 Key Benefits of Testamentary Trusts

- 2.4 Who Should Consider a Testamentary Trust?

- 2.5 Appointing a Trustee: A Vital Decision

- 2.6 Testamentary Trust vs Standard Will: What’s the Difference?

- 2.7 How to Set Up a Testamentary Trust in Australia

- 2.8 Final Thoughts